Customers expect their banking experiences to be as seamless and convenient as their everyday interactions with technology. Traditional banking methods often fall short, leading to frustration and dissatisfaction. The need for accessible, secure, and efficient banking services is more critical than ever.

This blog delves into the evolution and significance of integrated delivery channels in banking, exploring how they can address common pain points such as accessibility, security, and user experience.

Delivery channels in banking: A brief overview

Delivery channels in banking refer to the various methods through which banks provide services and interact with their customers. These channels facilitate transactions, account management, customer support, and the dissemination of financial information. Delivery channels aim to enhance customer convenience, improve accessibility, and ensure seamless banking experiences.

Over the years, banking delivery channels have evolved significantly, transforming the way customers interact with financial institutions. Here’s a concise exploration of their history and impact:

Timeline of delivery channels

Key features of modern delivery channels

Types of delivery channels

Strategies for implementing integrated delivery channels – Best practices and challenges to avoid

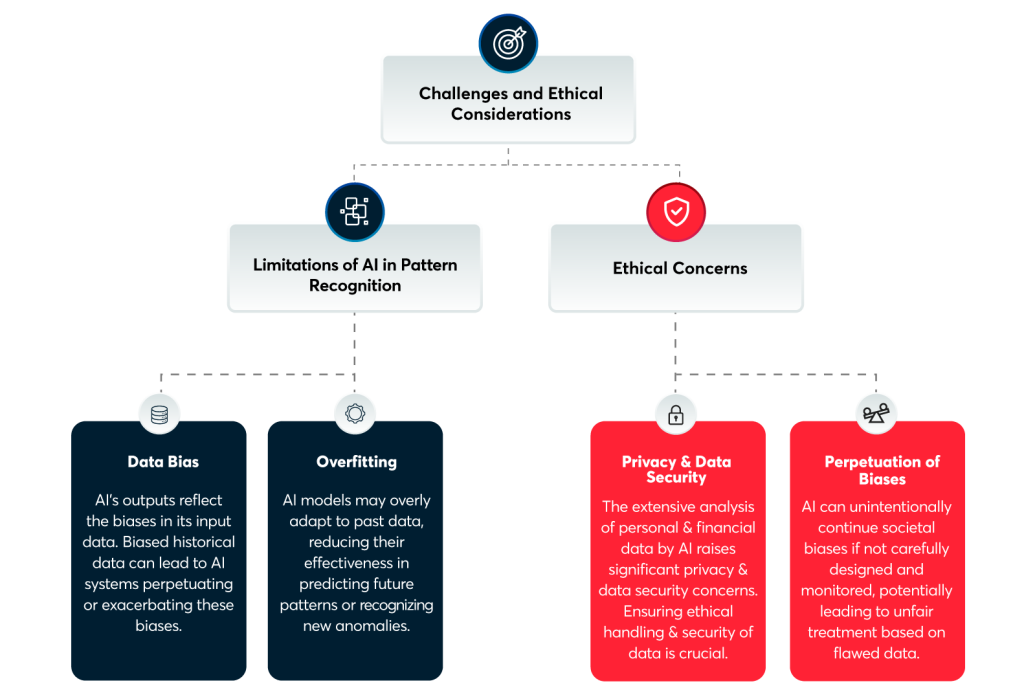

Data security and privacy

Implement robust encryption protocols (e.g., SSL/TLS) and multi-factor authentication (MFA) to protect sensitive customer data. Regularly update security measures and conduct security audits to identify vulnerabilities. Ensure compliance with data protection regulations such as GDPR and PCI DSS to avoid legal penalties and enhance customer trust.

Integration complexity

Use standardized APIs and middleware solutions to facilitate seamless integration between different banking systems and third-party services. Employ a microservices architecture to allow independent development and scaling of individual components, reducing the complexity of the overall system. Ensure thorough software testing and use continuous integration/continuous deployment (CI/CD) pipelines to streamline the integration process.

Legacy systems compatibility

Gradually modernize legacy systems by integrating them with new technologies using APIs and middleware. Implement a hybrid approach where legacy systems and modern solutions coexist, allowing for phased upgrades. Use enterprise service buses (ESBs) to facilitate communication between legacy systems and new platforms, ensuring data consistency and system compatibility.

User experience (UX) consistency

Design a unified user interface (UI) across all delivery channels to provide a consistent and seamless user experience. Conduct user research and usability testing to understand customer preferences and pain points. Implement responsive design techniques to ensure the UI adapts to different devices and screen sizes, maintaining a consistent experience.

Scalability and performance

Utilize cloud-based infrastructure to ensure scalability and handle varying transaction volumes. Implement load balancing and auto-scaling features to manage high-traffic periods efficiently. Optimize database performance by using indexing, caching, and efficient query practices. Monitor system performance in real time and use analytics to predict and address potential bottlenecks.

Regulatory compliance

Stay updated with local and international regulations affecting banking services. Implement compliance management software to monitor and ensure adherence to regulatory requirements. Conduct regular compliance audits and train staff on regulatory changes and their implications. Use encryption and secure data storage solutions to protect sensitive information and maintain compliance.

Customer adoption and trust

Provide clear communication about the benefits and security measures of integrated delivery channels to build customer trust. Offer tutorials and customer support to help users navigate new platforms and services. Use customer feedback to continuously improve services and address any concerns promptly. Ensure transparency in how customer data is used and protected.

Operational silos

Foster collaboration between different departments by using integrated platforms that provide a unified view of customer data and operations. Implement a centralized customer relationship management (CRM) system to ensure all departments have access to up-to-date customer information. Use cross-functional teams to develop and manage integrated delivery channels, promoting a holistic approach to service delivery.

Technology adoption

Provide comprehensive training programs for staff to familiarize them with new technologies and processes. Use change management strategies to facilitate smooth transitions and minimize resistance. Encourage a culture of continuous learning and innovation to keep pace with technological advancements. Involve employees in the development and implementation process to increase buy-in and adoption.

Cost management

Develop a clear implementation roadmap to prioritize investments and manage costs effectively. Use cost-benefit analysis to justify investments in new technologies and platforms. Leverage cloud services and scalable infrastructure to optimize resource usage and reduce capital expenditure. Continuously monitor and analyze the return on investment (ROI) to ensure cost-effectiveness and make necessary adjustments.

Enhance banking experiences with integrated delivery channels

Huge strides in financial technologies have enabled a number of delivery channels, benefiting both the customers and the banks. These technologies have also changed how customers interact with banks and financial institutions. Traditional banking channels will gradually find themselves replaced by newer and digital solutions.

As such, traditional banks stand at a risk of losing their customer base, if they do not adopt the latest financial solutions. Such banks and financial institutions can partner with a fintech services provider like VentureDive, and start by seeking consultancy and developing roadmaps for building their custom solutions.