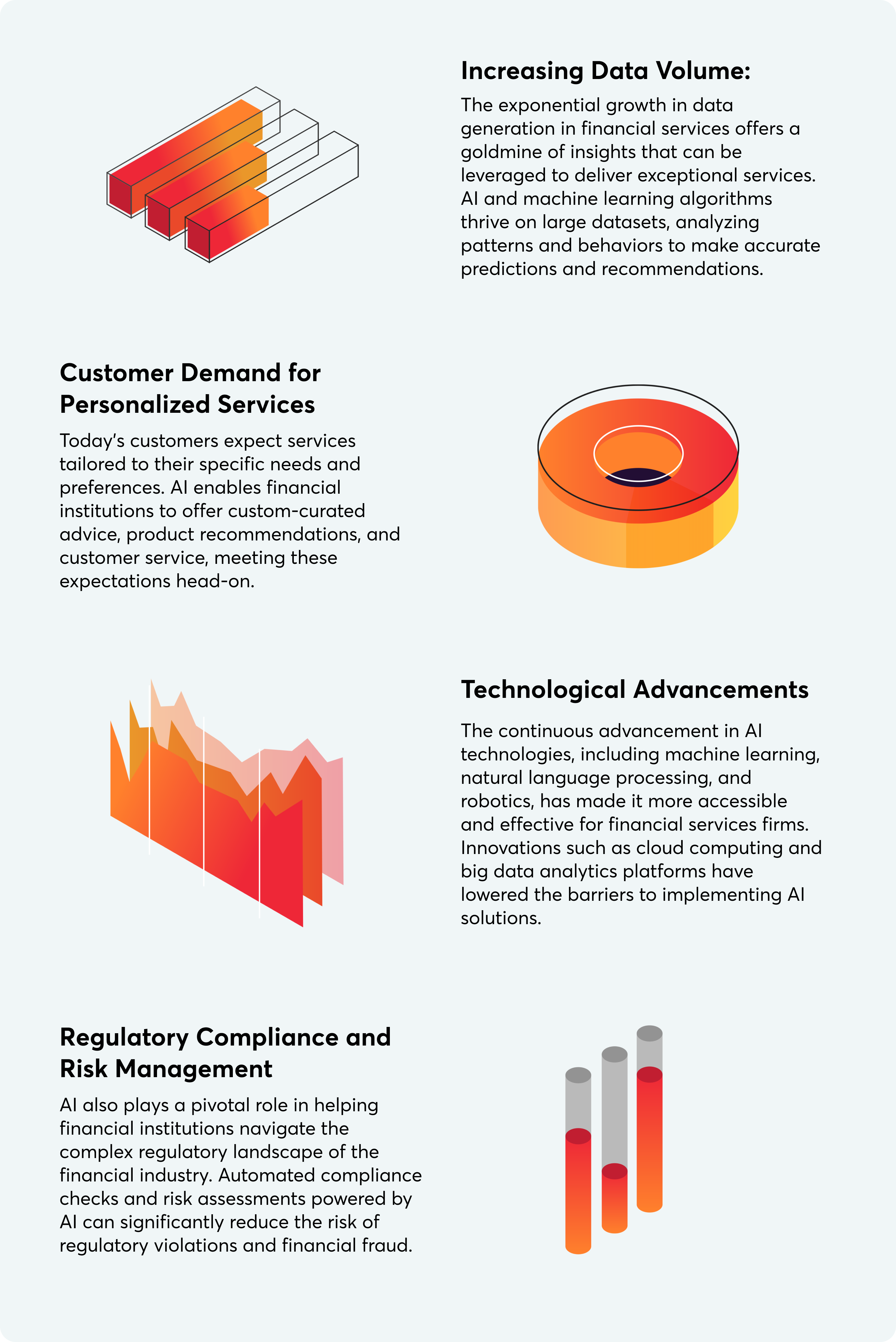

Banks have stopped using one-size-fits-all marketing. Now, they use detailed data analysis to give customers a tailored banking experience. This change is enabling banks to work smarter and improve their bottom line.

To tailor their services, banking institutions analyze transaction records, account holdings, and economic indicators. They then craft targeted marketing communications, suggest relevant products, and offer personalized services that align with individual customer requirements. This method bolsters the relevance of their customer interactions and fortifies a strategy of precision engagement.

Understanding advanced analytics in BFSIs

For years, data analytics has been a cornerstone in banking, crucial for everything from investment banking and credit scoring to securities trading. As technology advanced, big data analytics has started playing an even bigger role in banking and finance.

This evolution enables banks to predict trends, customize customer experiences, and make smarter decisions, making banking more innovative and customer-focused.

Core components of data analytics in banking

To fully embrace advanced data analytics, banks need to grasp the key components that power this technology. Think of advanced analytics as a four-layer cake, with each layer adding more flavor and depth to the bank’s understanding of data and customer behavior. The layers are further explained as follows:

| Reporting Collecting and making raw data understandable. | |

| Descriptive Analytics Processing information to spot patterns and trends. For instance, banks can segment customers based on their spending habits to tailor marketing strategies. | |

| Predictive Analytics Forecasting future behaviors and trends, allowing for the personalization of customer offerings. If a segment tends to buy certain products, predictive analytics helps tailor offers to match their anticipated needs. | |

| Prescriptive Analytics Using insights from both descriptive and predictive analytics to foresee outcomes and understand insights behind those outcomes. |

Types of risks faced by banks – Where advanced analytics help and how?

Advanced analytics aids banks in navigating a wide range of risks by enhancing their ability to predict, monitor, and mitigate potential issues more effectively.

| Applications of Advanced Analytics in Resolving Banks’ Risks | ||

| Credit Risk Improves credit scoring and predicts borrower behavior to minimize defaults. | Market Risk Forecasts market trends and evaluates portfolio impacts to hedge against losses. | Operational Risk Detects fraud and streamlines processes for safer, and more efficient operations. |

| Liquidity Risk Anticipates cash flow needs to ensure financial obligations are met on time. | Compliance Risk Monitors regulatory adherence and reduces legal and reputational risks. | Cyber Risk Predicts and detects cyber threats, enhancing data security and response strategies. |

Banking and data analytics – Implementation and applications

Use cases and benefits of data analytics in banking

- Credit Scoring and Approval: Advanced analytics improve the accuracy and efficiency of the credit approval process. For example, JPMorgan Chase uses machine learning to assess the creditworthiness of loan applicants, analyzing vast datasets to predict loan default risks more accurately.

- Customer Segmentation: This allows banks to segment customers based on behavior and preferences. Bank of America, for instance, uses predictive analytics to optimize its ATM network, forecasting cash demand patterns to ensure ATMs are adequately filled with the necessary cash.

- Personalized Product Recommendations: Predictive analytics enable banks to suggest relevant products to customers. Wells Fargo leverages customer transaction histories and behavior to offer customized financial advice and product recommendations.

- Fraud Detection Systems: Real-time detection of unusual transactions minimizes losses. Citibank employs analytics algorithms to monitor transactions, identifying potential fraud and freezing suspicious transactions before processing.

- Operational Optimization: Analytics help identify inefficiencies in internal processes. By analyzing these processes, banks can optimize their cashflows and streamline operations.

- Market Trend Analysis: Analytics are used to forecast market trends. Goldman Sachs analyzes market trends and their potential impact on their portfolio, making swift decisions to hedge against potential losses.

- Regulatory Compliance Monitoring: Advanced banking analytics automate the tracking and reporting of transactions. This ensures compliance with regulations, reducing the risk of fines and penalties.

- Improved Sales Management: Analytics drive effective sales strategies. For example, a European bank used machine learning algorithms to predict customer churn, launching a targeted campaign that reduced churn by 15%.

- Cybersecurity Management: Banks use analytics to detect and respond to cyber threats swiftly. For instance, a US bank corrected patterns of unnecessary discounts offered by private bankers, increasing revenues by 8% within a few months.

- Enhanced Spend Analytics: Providing customers with insights into their spending patterns is another benefit. A top consumer bank in Asia defined 15,000 microsegments in its customer base using analytics, tripling the likelihood of customers purchasing the next product.

- Liquidity and Cash Forecasting: Granular forecasting enables banks to optimize cash management.

- Predictive Maintenance: Analytics predict when systems may fail, allowing for preemptive maintenance.

- Application Screening: Streamlining the application screening process makes it faster and more accurate.

- Customer Analytics: Deep analysis of customer behavior data leads to personalized banking experiences.

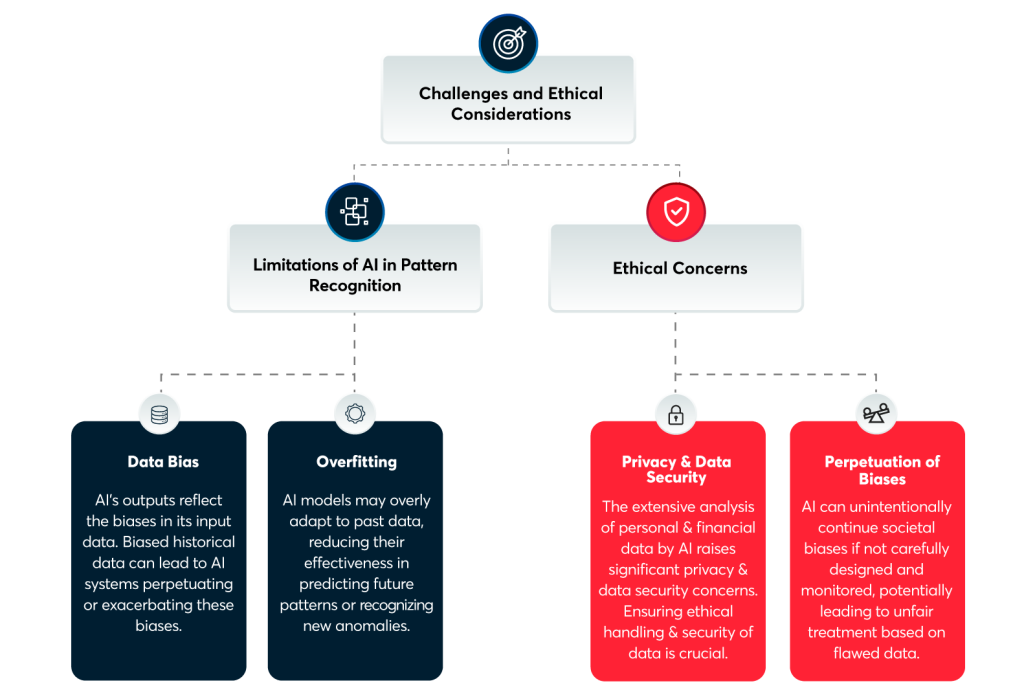

Obstacles to implementing advanced analytics in banking

| Data Quality and Integration: Harmonizing disparate data for accuracy and usability. | Privacy and Regulatory Compliance: Balancing data analytics with stringent privacy laws. | Skills Gap and Talent Acquisition: Bridging the skills gap in analytics expertise. | Cultural and Organizational Resistance: Overcoming internal skepticism towards new tech adoption. |

| Cost and Complexity of Implementation: Navigating the high costs and complexities of new technologies. | Keeping Pace with Technological Advancements: Staying updated with rapidly evolving analytics technologies. | Security Concerns: Safeguarding data against increasing cyber threats. | Measuring ROI: Demonstrating the financial value of analytics investments. |

The future of analytics in banking – Key considerations

Navigating the challenges of adoption—ranging from data integration and regulatory compliance to talent acquisition and security concerns—requires a strategic approach and a commitment to innovation. For banks looking to harness the full power of advanced analytics, partnering with a specialized technology solutions provider like VentureDive is a pivotal step. Connect with our experts to find out how we can help you keep pace with the rapid technological advancements.