The traditional manual approaches to compliance are becoming outdated. As regulations increase in number and complexity, businesses face a growing challenge in staying compliant with an ever-expanding array of regulations. This issue spans across sectors, impacting companies of all sizes, and leading to a significant drive towards automated regulatory compliance.

Automated compliance solutions offer a streamlined way to ensure adherence to regulations, reducing the risk of human error and the anxiety over potential non-compliance penalties.

Greg, a compliance officer in a fintech company, typically occupies himself with two major concerns:

- Safeguarding personal data

- Securely handling sensitive user information

The stakes are high, as failure in these areas could lead to severe financial penalties and erosion of customer trust. Greg’s search for robust security measures is driven by the need to adapt to both emerging threats and changing regulations.

For Greg and many others in similar positions, automated compliance tools promise simplified compliance processes. This makes understanding the complexities of data protection and handling of sensitive information easy. It is a strategic move towards more efficient, reliable, and secure business operations.

Outcomes of Automated Regulatory Compliance

Automated regulatory compliance refers to using technology solutions to manage and meet regulatory requirements efficiently. In essence, it’s about employing software that streamlines the complex and often cumbersome process of keeping up with regulations.

Automated regulatory compliance is increasingly becoming a staple in modern business operations. It is due to its potential to significantly reduce the time and resources spent on compliance tasks, minimizing human error and ensuring a higher level of precision.

The significance of this shift towards automation is underscored by the growing costs and risks associated with non-compliance. Failing to meet regulatory standards can lead to hefty penalties, which have reached an alarming average cost in recent years, emphasizing the financial risks of non-compliance.

Non-compliance with financial rules and regulations can have severe repercussions beyond financial penalties, severely damaging a business’ reputation. Such violations may lead to customer churn, and negative media coverage, and deter potential clients and investors. The tarnished reputation can decrease market value and increase regulatory scrutiny, raising compliance costs. In severe cases, it can result in legal actions and potentially lead to business closure. Hence, maintaining compliance is essential not just legally but for sustaining a company’s credibility and financial stability.

Sector-Specific Compliance Challenges

The implementation of AI-based regulatory compliance presents unique challenges across different sectors that businesses need to navigate carefully. Some use cases are as follows:

CPG Retail

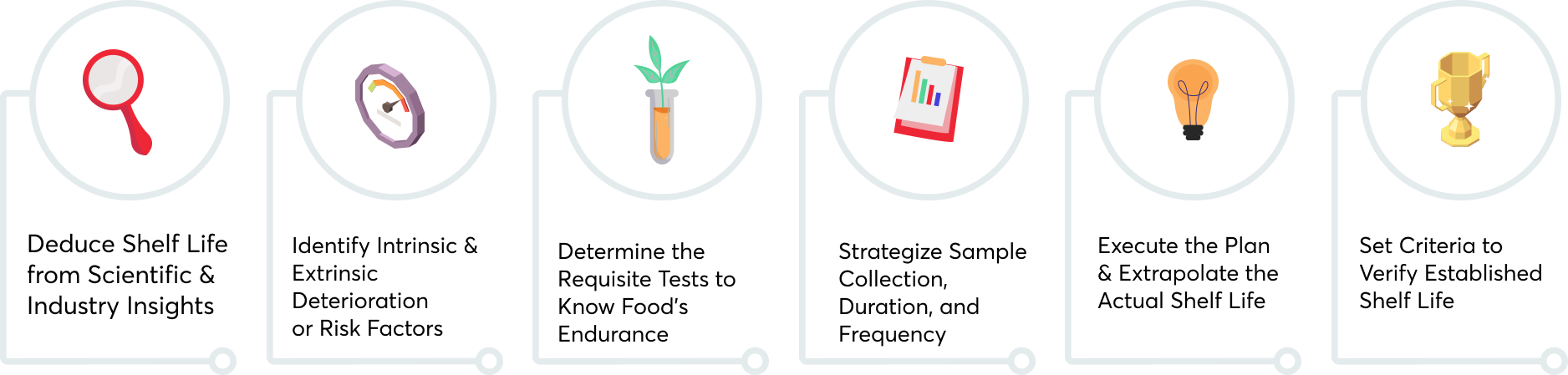

In the CPG (Consumer Packaged Goods)/retail sector, the regulatory compliance workflow focuses heavily on consumer safety and product standards. The requirements are often related to product labelling, safety testing, and environmental impact, ensuring that products are safe for consumption and accurately represented to consumers. Key compliance protocols in this sector include:

Fintech

The Fintech sector deals with more stringent compliance requirements, driven by the need to protect consumers’ financial information, ensure transaction security, and prevent financial crimes. Important FinTech regulations include:

Healthcare

Healthcare compliance is critically focused on patient data protection and clinical standards to ensure patient safety and confidentiality, especially when it comes to healthcare technologies. The sector must comply with the following regulations such as:

Implementing Automation for Compliance Management

Businesses are increasingly adopting automation compliance solutions to manage complex regulations. This involves using advanced tools that streamline processes by applying data analytics to improve compliance practices.

Benefits of Automated Compliance Management

Automated compliance solutions empower how businesses approach regulatory obligations, offering several advantages that significantly enhance overall operations.

Improved Efficiency and Accuracy

Automation in compliance management streamlines the collection, processing, and reporting of compliance-related data, reducing the need for manual intervention. This not only accelerates workflows but also minimizes the risk of human errors, ensuring that compliance data is both accurate and reliable. For example, using automated systems for tracking and managing compliance requirements can cut down the time teams spend on manual data entry and verification, allowing them to focus on more strategic tasks.

One of the world’s largest banking and financial services organizations, HSBC, utilized automation and AI in its compliance processes to enhance efficiency and accuracy. The bank implemented AI-driven tools to improve its anti-money laundering (AML) and fraud detection processes. This led to a significant reduction in false positives and more effective identification of potential fraudulent activities.

Enhanced ROI

By automating compliance tasks, businesses can allocate their resources more effectively, resulting in a better ROI. Automated systems reduce the need for extensive manual labor, lower the risk of non-compliance penalties, and help avoid the costs associated with compliance failures, such as data breaches or regulatory fines. Moreover, these systems can adapt to new regulations quickly, preventing costly overhauls of compliance programs whenever there are regulatory changes.

A leading internet infrastructure provider tackled compliance with the Sarbanes-Oxley Act (SOX) and the Health Insurance Portability and Accountability Act (HIPAA) by leveraging MetricStream’s solutions. This approach centralized their internal controls, streamlined workflows, and enhanced reporting capabilities, resulting in improved operational testing and risk assessment abilities. The comprehensive dashboard provided by MetricStream offered a panoramic view of internal controls and compliance processes, highlighting high-priority cases and facilitating effective communication with stakeholders.

Impact on Audit Processes

The implementation of automated compliance management significantly improves the auditing process. It provides auditors with easy access to a centralized repository of compliance information, streamlining the audit workflow. This means audits can be completed faster and with greater confidence in the integrity of the compliance data. Automated logs and tracking of compliance actions also offer auditors detailed insights. These insights convert into the compliance posture of a business at any given time, enhancing the overall auditing experience.

To comply with various global regulations, Airbnb has employed automated systems to manage and monitor its vast amount of user data and transactions. This has enabled the company to efficiently handle regulatory requirements across different countries, promising user safety and data protection while maintaining a strong compliance posture.

Conclusion

Automated regulatory compliance reduces risks by optimizing and enhancing the accuracy of compliance processes. With technological advancements and AI integration, the future of compliance management is set to become more efficient and less prone to human error. Businesses can focus more on their core activities by leveraging technology to ensure compliance. It will allow them to innovate and grow while staying compliant with their regulatory obligations.

VentureDive is your trusted partner in this journey, leveraging AI to offer tailored regulatory compliance solutions that safeguard your operations against compliance pitfalls. Discover how VentureDive can transform your compliance management with innovative, AI-powered solutions.