About Project

Tez Financial Services (TFS) is a Financial Technology (FinTech) startup that started out by giving nano loans to people who were in need of instant cash. It is a financial inclusion app, and involves digital lending, insurance, savings & investments. The purpose behind Tez Financials is to become a primary financial service provider for the unbanked and underbanked in Pakistan, and allow fast access to cash to people from all socioeconomic classes. Hence, its name – Tez Financials.

Region

Pakistan

Industries

Financial Services

Technologies

React.js, Node.js,

SEIZING THE OPPORTUNITY

Improving lives by enabling people to access instant cash

Technology has become an integral part of today’s financial landscape. It’s about making transactions (e.g. money transfers, payments, loans, and more) simpler, quicker and more efficient than conventional banking systems. There were a number of problems with the latter:

- When it comes to loans, traditional banking systems offer loans in fixed amounts, which are usually quite large for low-income classes to afford.

- They also require extensive verification and processing, including a certain income level of the person who applies for the loan. If someone doesn’t fulfill those criteria, their loan request won’t be accepted.

- Banks take days to process a loan request, which is highly unfeasible for someone who needs money urgently, and on short notice.

Tez Financials is a FinTech solution that gives out nano loans, up to PKR 10,000 — it’s basically for those who don’t have cash at hand and need it for urgent use. Tez Financials is not backed by a bank and does not have a wallet of its own. The company simply wanted to bridge the gap between microfinance and people from across all social classes.

CREATING THE SOLUTION

Making finance accessible through a mobile app

Noureen Hyat, the Founder of Tez Financials, reached out to VentureDive with her idea. They had a problem statement, they had the solution idea, but they didn’t know how to go about its execution. So we held a number of meetings, and decided how we’ll go about the development and design to produce an optimal application.

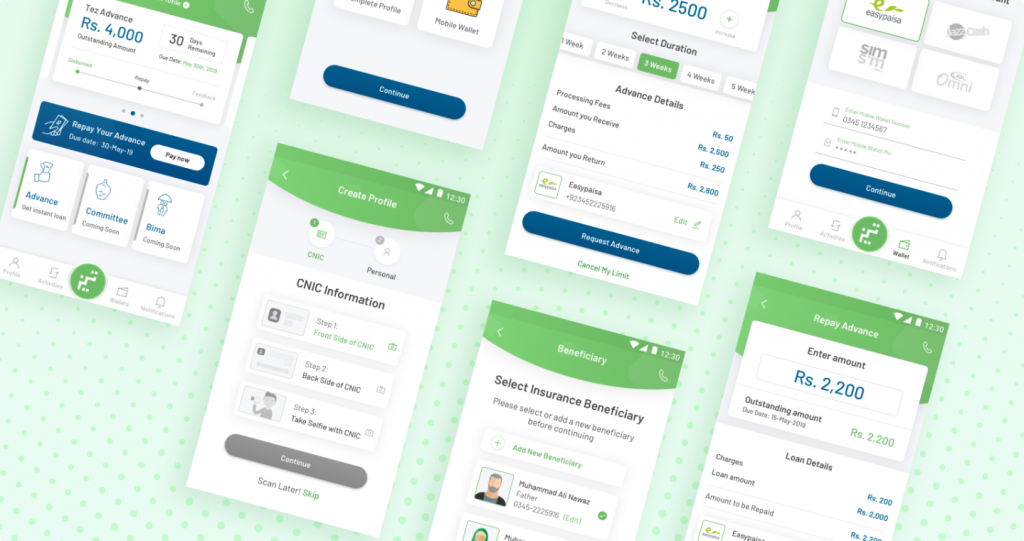

Engaging as technology partners with Tez Financials, VentureDive began the development of an android application and an admin portal. As of today, the admin portal is used by agents and managers at Tez Financials, whereas the mobile app is openly available to the public. It can be downloaded from Google’s PlayStore, and you can signup with your details to avail the mini loan, all within 15 minutes. The app is extremely easy to use with audio recordings automatically played at each step for guiding the users about what to do next. Customers can also sign up or log in with their social accounts like Google and Facebook.

Growing securely with VentureDive’s technology consulting

Since Tez Financials is a financial app, our prime concern was to maintain security and set up strict protocols to prevent fraud or breaches. Whatever the circumstances, our goal was to never let security be compromised.

Here are a few security protocols that we’ve incorporated with Tez Financials:

- SSL Pinning to prevent man-in-the-middle attacks

- Token-based communication between client & server

- Encrypted request & response payloads as a second line of defense

- Role-Based security enabled for web portals, provided by Keycloak

- Android code obfuscation using Dexguard

- Penetration testing performed on Android application

Since the beginning of our partnership, our focus has been on educating the Tez Financials team about security issues and loopholes that existed and could occur in the future. We don’t integrate any API or SDK which isn’t developed by a reliable provider – this is how we avoid vulnerability to attacks.

VentureDive’s consulting services for Tez Financials revolve around technology and security consulting. It’s on us to suggest what’s best for Tez Financial’s software infrastructure, what risks may surface if they want to implement a certain functionality or integrate external plugins, and what’s the best way to mitigate those risks.

CELEBRATING THE SUCCESS

Moving forward: Future roadmap

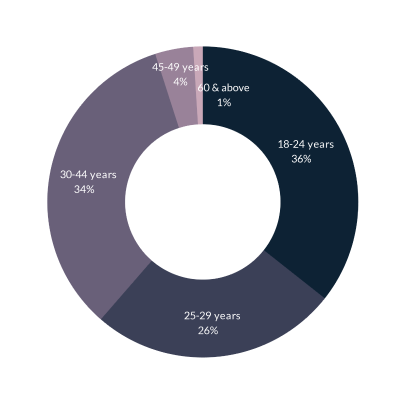

Currently, Tez Financials is being used by more than 1 lakh people across Pakistan. Tez Financials foresees to substantially increase the user base in the coming years by introducing more services and discounts.

During our discussion with one of their representatives, they shared their plans of two more services that are still in the planning and development phase: Tez Financials Committee & Tez Financials Gold.

VentureDive looks forward to continuing to work with Tez Financial Services and helping them grow and evolve within the FinTech industry and beyond.

Results & impact to date